Back

10 Feb 2023

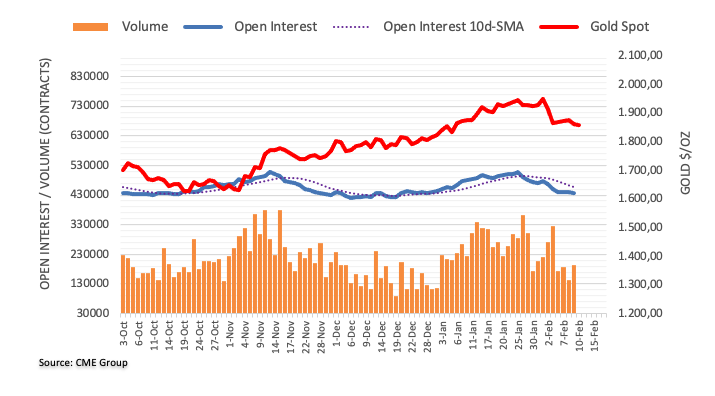

Gold Futures: Extra losses appear not favoured

CME Group’s flash data for gold futures markets noted traders reduced their open interest positions for yet another session on Thursday, this time by nearly 3K contracts. On the other hand, volume kept the choppiness intact and increased by around 50.6K contracts after the previous daily drop.

Gold: Interim support comes at the 55-day SMA

Thursday’s drop in gold prices was amidst shrinking open interest, which is supportive that a sustained decline appears not favoured in the very near term. Extra downside in the yellow metal is expected to meet a provisional support at the 55-day SMA at $1846 for the time being.