US dollar index slides again, falls to 1-week lows

The US dollar lost ground for the second day in a row in the currency market. Like what happen yesterday, better-than-expected economic data failed to boost the greenback. Equity prices pulled back and US bonds recovered ground.

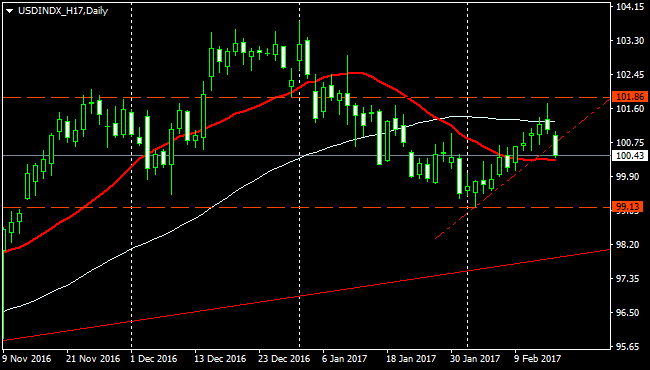

The US dollar index suffered the worst decline since the beginning of the month. The index bottomed at 100.37, the lowest in a week, and it was about to end the day hovering around 100.40/45. From Wednesday’s high it has fallen 1.30%.

The Dow Jones was falling 0.15% and the Nasdaq was down 0.30%. In the bond market, “US 10yr treasury yields fell from 2.49% to 2.44% and 2yr yields fell from 1.253% to 1.20%. Fed fund futures slipped 1bp-4bp, the April contract now trading at 0.72%, which implies around a 40% chance of a rate hike in March)”, explained analysts from Westpac.

DXY levels

To the downside, support levels might lie at 100.30 (20-day moving average), 100.00 (psychological) and 99.10. On the upside, resistance could now be seen at 101.05 (Feb 16 high), 101.35/40 (Feb 14) and 101.70/75 (Feb 15 high).