EUR/USD around 1.1170 post-German CPI

The single currency stayed apathetic following the German inflation figures, with EUR/USD hovering over the 1.1170/80 region.

EUR/USD unchanged on data

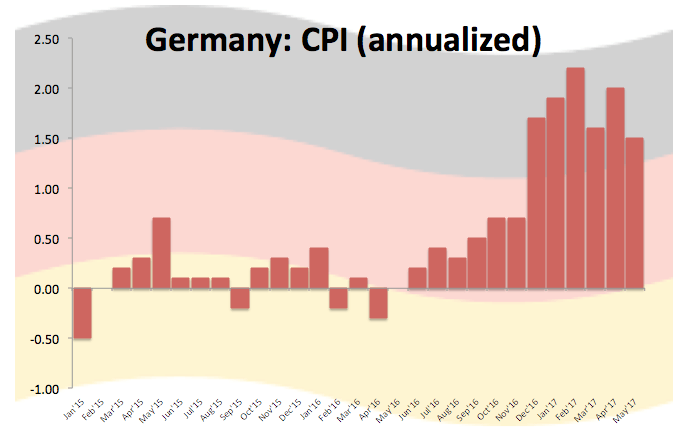

The pair kept the composure after advanced German inflation figures tracked by the CPI showed consumer prices are expected to rise at an annualized 1.5% and to contract at a monthly 0.2%.

Measured by the broader HICP, prices are seen rising 1.4% on a year to May and dropping 0.2% inter-month.

Spot attempted a bull run to the 1.1190/95 band soon after the releases, although it has quickly retraced the move.

Looking ahead, US personal income/spending are next on tap seconded by inflation figures gauged by the PCE and the speech by FOMC’s L.Brainard (permanent voter, centrist).

EUR/USD levels to watch

At the moment, the pair is up 0.02% at 1.1169 and a breakout of 1.1193 (high May 30) would target 1.1235 (high May 26) en route to 1.1252 (high May 25). On the other hand, the immediate support aligns at 1.1110 (low May 30) followed by 1.1073 (76.4% Fibo of 1.1300-1.0339) and finally 1.1059 (20-day sma).