WTI drops to session lows near $67.50 ahead of rig count

- Prices of the black gold are deflating towards the $67.50 area.

- WTI is down for the second day in a row after recording 3-year highs.

- US oil rig count next on tap later in the NA session.

Prices of the barrel of the West Texas Intermediate are prolonging the correction from recent tops and are challenging the area of 2-day lows in the mid-$67.00s.

WTI looks to rig count

Prices of the barrel of the American benchmark for the sweet light crude oil have given away initial gains and returned to the negative territory after President Trump said via Twitter that ‘oil prices are artificially high, will not be accepted’.

Adding to the downside in crude prices, there seems to be increasing scepticism over the likeliness of an extension of the OPEC/non-OPEC output cut deal beyond the original deadline. Furthermore, Russia’s A.Novak said the country might not stay committed to the current output cut agreement until the end of 2018.

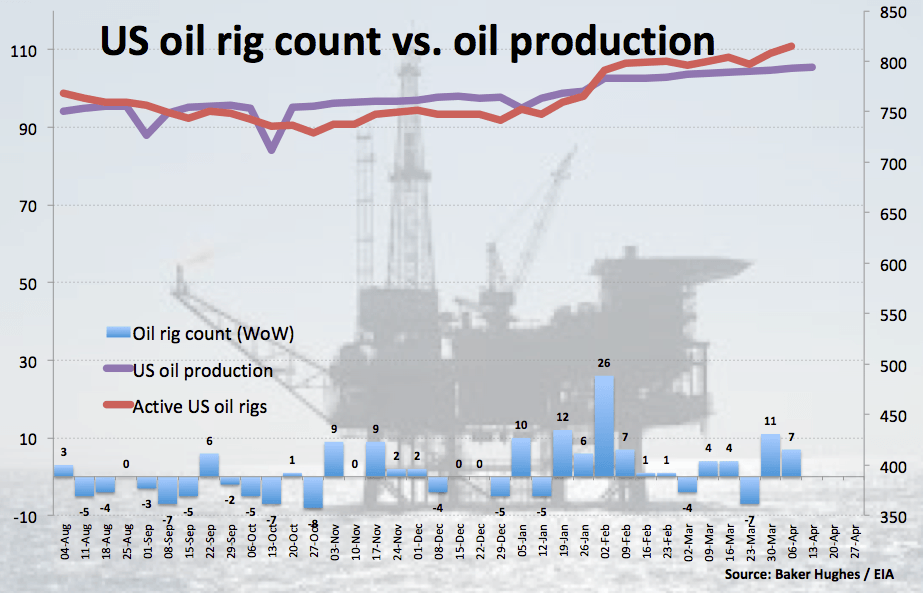

Looking ahead, driller Baker Hughes will report on US oil rig count (+7 prev.).

WTI significant levels

At the moment the barrel of WTI is down 0.70% at $67.73 and a break below $66.77 (10-day sma) would expose $65.56 (low Apr.17) and then $65.28 (21-day sma). On the upside, the next hurdle aligns at $69.55 (2018 high Apr.19) followed by $69.66 (monthly high Dec.2014) and finally $70.00 (psychological level).