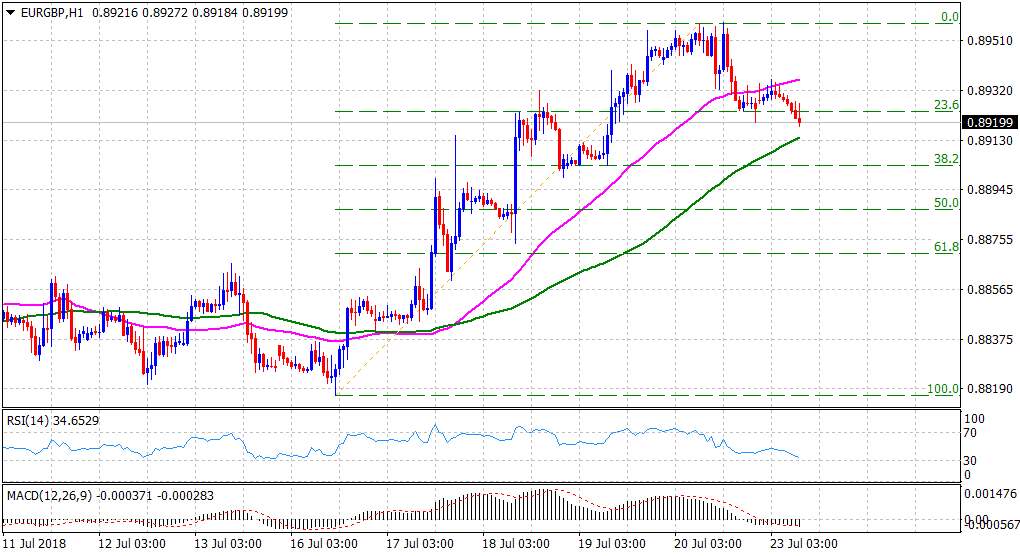

EUR/GBP Technical Analysis: Retreats farther from over 4-month peak set on Friday

• The pair's early uptick met with some fresh supply near 50-hour SMA, with bears now looking to extend last week's retracement slide from over four-month tops.

• Short-term technical indicators are gradually picking up negative momentum and a follow-through weakness below 100-hour SMA will reinforce prospects for additional weakness.

• Only a sustained move beyond daily swing high might negate the negative outlook and pave the way for the resumption of the prior appreciating move.

EUR/GBP 1-hourly chart

Spot rate: 0.8920

Daily High: 0.8936

Trend: Short-term bearish

Resistance

R1: 0.8636 (current day swing high)

R2: 0.8975 (R2 daily pivot-point)

R3: 0.9000 (psychological round figure mark)

Support

S1: 0.8910 (S1 daily pivot-point)

S2: 0.8874 (last Thursday's swing low)

S3: 0.8820 (200-day SMA)