Back

14 Sep 2018

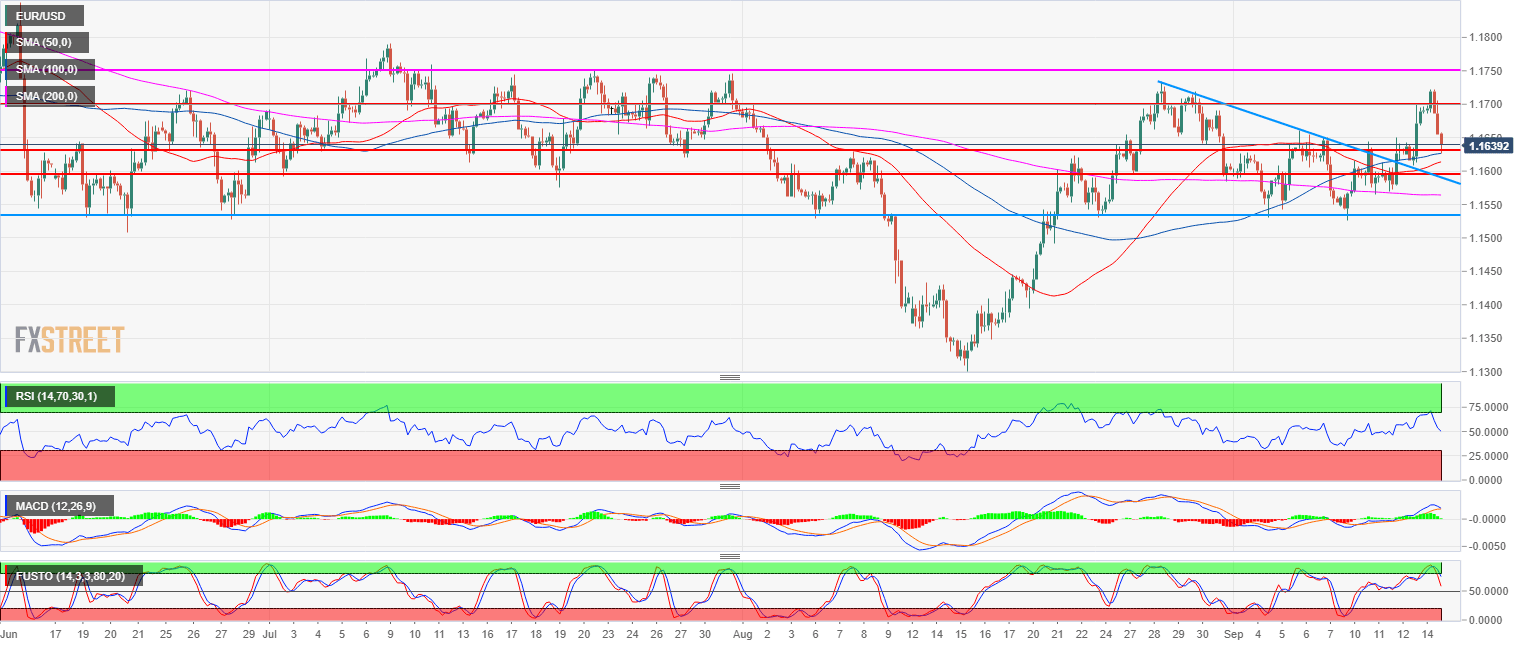

EUR/USD Technical Analysis: Lots of noise for nothing - First down day in five - EUR/USD bears need to do better than this

- EUR/USD main bear trend is on hold since mid-August where EUR/USD established a bootom at the 1.1300 figure.

- This Friday, EUR/USD bears drove the market down to 1.1630 support after a failed breakout above 1.1700 resistance. This is the first down day in five and EUR/USD bears will need to continue hammering down the market below 1.1530 key support in order to reclaim a strong bearish directional bias.

- EUR/USD is still trading above its 50, 100 and 200-period simple moving averages while the RSI and Stochastics indicators are trading down from overbought condition. All-in-all suggesting that the market might need to consolidate more before setting up for the next directional move.

- A bear breakout below 1.1530 would invalidate the bullish bias.

EUR/USD 4-hour chart

Spot rate: 1.1639

Relative change: -0.44%

High: 1.1722

Low: 1.1626

Main trend: Bearish

Short-term trend: Bullish above 1.1530

Resistance 1: 1.1654 August 27 high

Resistance 2: 1.1700 figure

Resistance 3: 1.1750 key resistance (July)

Resistance 4: 1.1800 figure

Support 1: 1.1630 August 8 high key level

Support 2: 1.1600 figure

Support 3: 1.1572 July 19 low

Support 4: 1.1542 supply/demand level

Support 5: 1.1530 August 23 swing low

Support 6: 1.1508 June 8 low