Back

6 Feb 2019

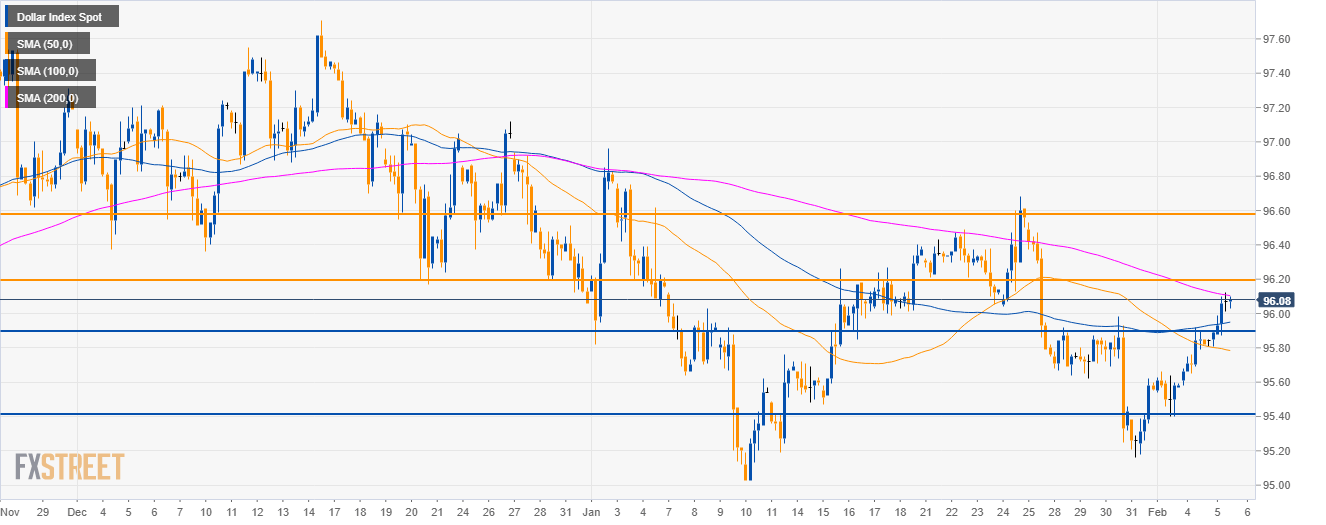

US Dollar Index Technical Analysis: DXY pushes above the 96.00 figure and challenges the 4-hour 200 SMA

DXY 4-hour chart

- The US Dollar Index (DXY) is challenging the 200 SMA.

- A break above it and the 96.20 resistance can open the gates to the 96.60 level.

- On the way down, investors can expect support at 95.90 and 95.40 level.

Additional key levels

Dollar Index Spot

Overview:

Today Last Price: 96.08

Today Daily change %: 0.27%

Today Daily Open: 95.82

Trends:

Daily SMA20: 95.88

Daily SMA50: 96.45

Daily SMA100: 96.16

Daily SMA200: 95.32

Levels:

Previous Daily High: 95.92

Previous Daily Low: 95.58

Previous Weekly High: 95.98

Previous Weekly Low: 95.16

Previous Monthly High: 96.96

Previous Monthly Low: 95.03

Daily Fibonacci 38.2%: 95.79

Daily Fibonacci 61.8%: 95.71

Daily Pivot Point S1: 95.63

Daily Pivot Point S2: 95.43

Daily Pivot Point S3: 95.29

Daily Pivot Point R1: 95.97

Daily Pivot Point R2: 96.11

Daily Pivot Point R3: 96.31