Back

22 Mar 2019

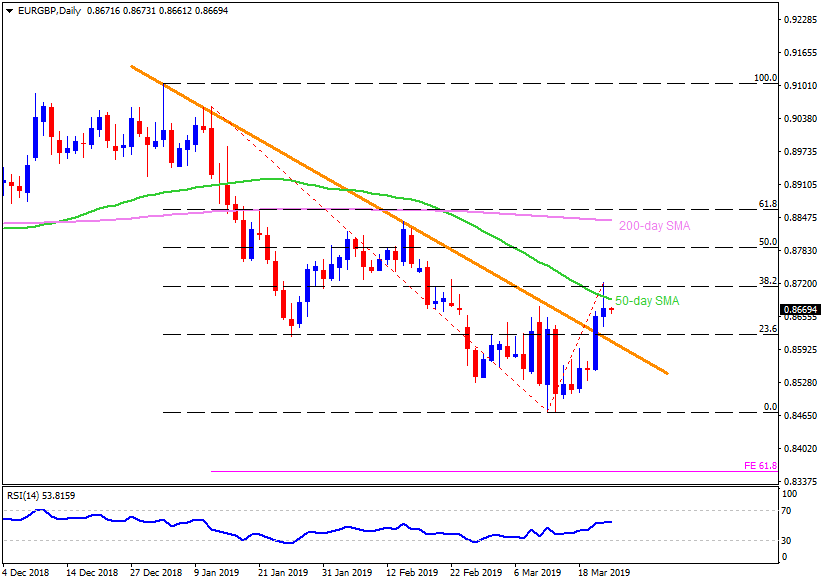

EUR/GBP Technical Analysis: Failure to surpass 50-day SMA continues to highlight 0.8610 support

- EUR/GBP is a little weak around 0.8665 on early Friday.

- The quote couldn’t provide a daily closing beyond 50-day simple moving average (SMA) figure of 0.8690 during its rise on Thursday.

- As a result, a downward sloping trend-line stretched since January 03 at 0.8610 regain market attention as a break of which triggered the pair’s recent rise.

- Should the pair slips under 0.8610, 0.8560, 0.8520 and 0.8500 might entertain short-term sellers ahead of pleasing them with an early-month low around 0.8470.

- In a case where prices drop beneath 0.8470, 61.8% Fibonacci expansion (FE) of pair moves since January, at 0.8360, could flash on bears’ radar to target.

- On the upside, a D1 close beyond 0.8690 could validate the pair’s rise in a direction to 0.8740 and 50% Fibonacci retracement level near 0.8790.

- However, 200-day SMA level of 0.8845 may confine the pair’s rally beyond 0.8790, if not then chances of 0.8950 and 0.9000 coming back to the chart can’t be denied.

EUR/GBP daily chart