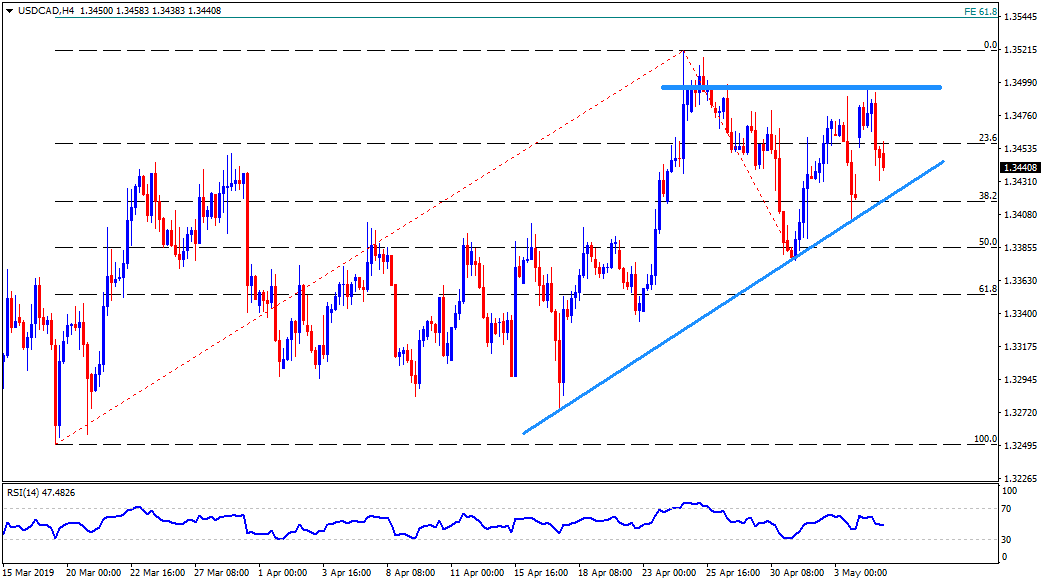

USD/CAD technical analysis: 3-week old support-line can help bulls to aim 1.3495/1.3500

- The near-term trend-line support could restrict the latest pullback.

- Overall sentiment remains mixed as RSI remains around 50.00 mark.

The failure to cross 1.3495 – 1.3500 resistance-zone drags the USD/CAD pair down to 1.3445 level during the early Asian session on Tuesday.

The quote seems to decline towards three-week long upward sloping support-line stretched since April 17, at 1.3420 now.

However, pair’s further downside past-1.3420 is less likely as 38.2% Fibonacci retracement of March to April rise increases the strength of the same support.

As a result, chances of the pair’s uptick to 1.3480 and then to 1.3495/1.3500 are high.

Should there be increased buying past-1.3500, April month tops near 1.3520 and 61.8% Fibonacci expansion (FE) of the said move at 1.3545 can please buyers.

In a case where 1.3420 rest-point fails to disappoint sellers, 1.3400 and recent lows around 1.3380 could come back on the chart.

Additionally, 1.3330 and 1.3300 may lure bears past-1.3380 support.

It should also be noted that 14-bar relative strength index (RSI) show a lack of strength in the price momentum as it fluctuates near 50.00 mark.

USD/CAD 4-Hour chart

Trend: Pullback expected