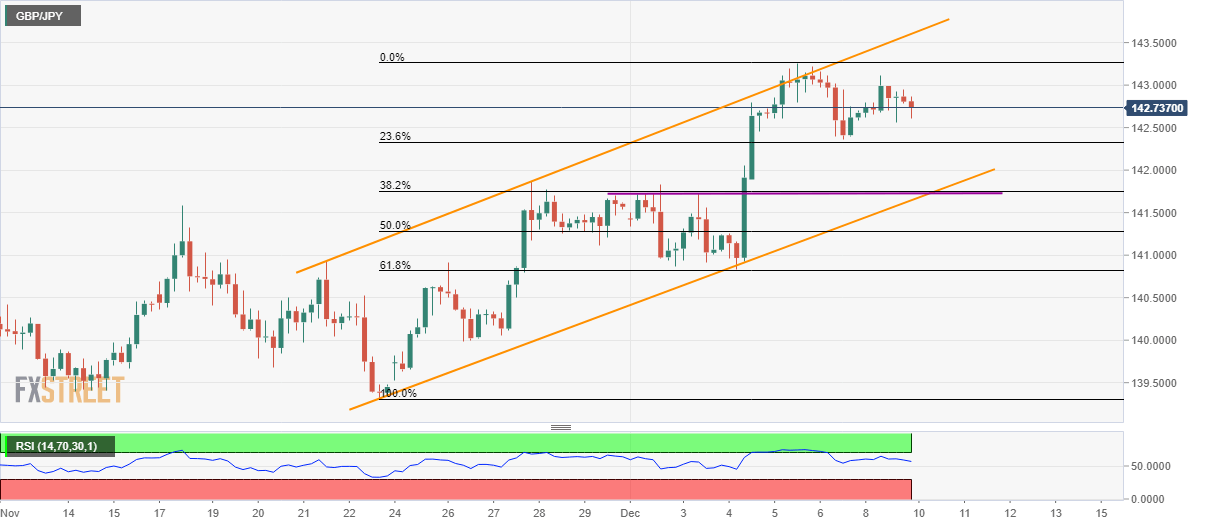

GBP/JPY Technical Analysis: Sellers look for entry below 141.75/65

- GBP/JPY again fails to stay strong beyond 143.00.

- Short-term horizontal support, the lower line of two-week-old ascending trend-channel keep the buyers hopeful.

- March/April lows to gain the Bull’s attention during a fresh upside.

GBP/JPY stays under pressure around 142.70 during Tuesday’s Asian session. The pair repeatedly fails to sustain its run-up beyond 143.00 while pulling back from the seven month high.

However, sellers wait for entry below the support line of near-term ascending trend-channel and an immediate horizontal line, around 141.75/65. In doing so, 23.6% Fibonacci retracement of November 22 to December 05 upside, near 142.30, can act as an intermediate halt.

Should prices decline below 141.65, 61.8% Fibonacci retracement around 140.80 and 140.00 round-figure will lure sellers.

Meanwhile, a sustained run-up beyond 143.00 needs validation from the current month high of 143.26 to aim for lows marked in March and April around 143.72/77area.

GBP/JPY four-hour chart

Trend: Pullback expected