USD/CHF Price Analysis: Bullish consolidation above 0.9700 mark, 100-DMA support

- USD/CHF struggled for a firm direction and seesawed between tepid gains/minor losses on Monday.

- The technical set-up still seems tilted in favour of bulls and supports prospects for additional gains.

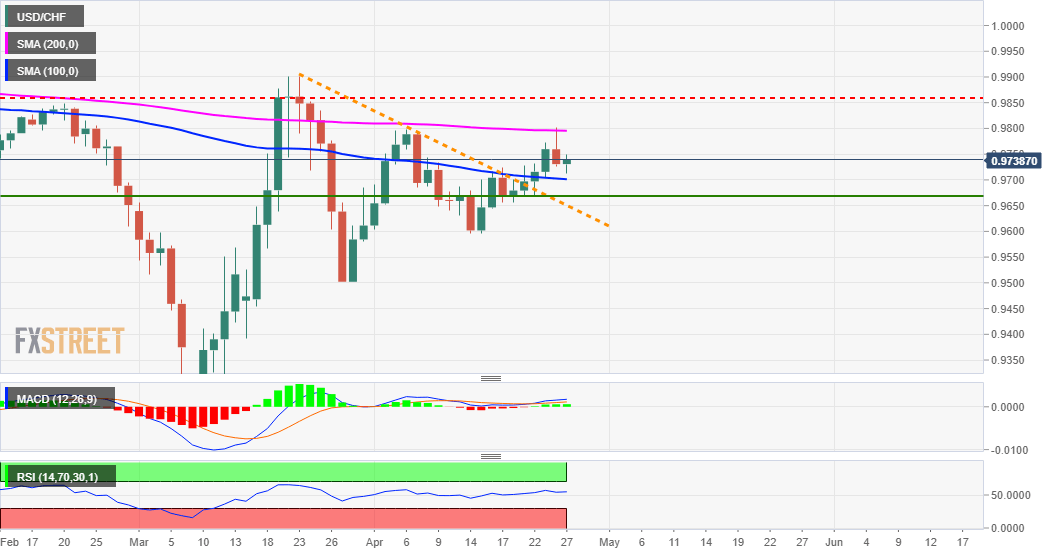

The USD/CHF pair extended its sideways consolidative price action through the mid-European session and remained confined in a 35-40 pips narrow trading band, above the 0.9700 mark.

The mentioned level coincides with 100-day SMA, which should now act as a key pivotal point for short-term traders and help determine the pair's next leg of a directional move.

Given last week's sustained move beyond a symmetrical triangle resistance, the set-up still seems tilted in favour of bullish traders and supports prospects for additional gains.

Moreover, technical indicators on the daily chart maintained their bullish bias and add credence to the constructive outlook amid a further improvement in the global risk sentiment.

In the meantime, the 0.9750-60 region now seems to have emerged as immediate resistance and is followed by the very important 200-day SMA, around the 0.9800 round-figure mark.

Bulls are likely to wait for some strong follow-through strength beyond the said hurdle before positioning for any further appreciating move, towards the 0.9855-60 supply zone.

On the flip side, weakness below 100-DMA might still be seen as a buying opportunity and should help limit the downside near the triangle breakpoint, around the 0.9670 region.

USD/CHF daily chart

Technical levels to watch