EUR/GBP Price Analysis: Rallies to the highest level since March 31, retakes 0.8900 mark

- EUR/GBP finally breaks out of a near-term trading range held over the past seven weeks.

- The near-term technical set-up now supports prospects for a move towards the 0.90 mark.

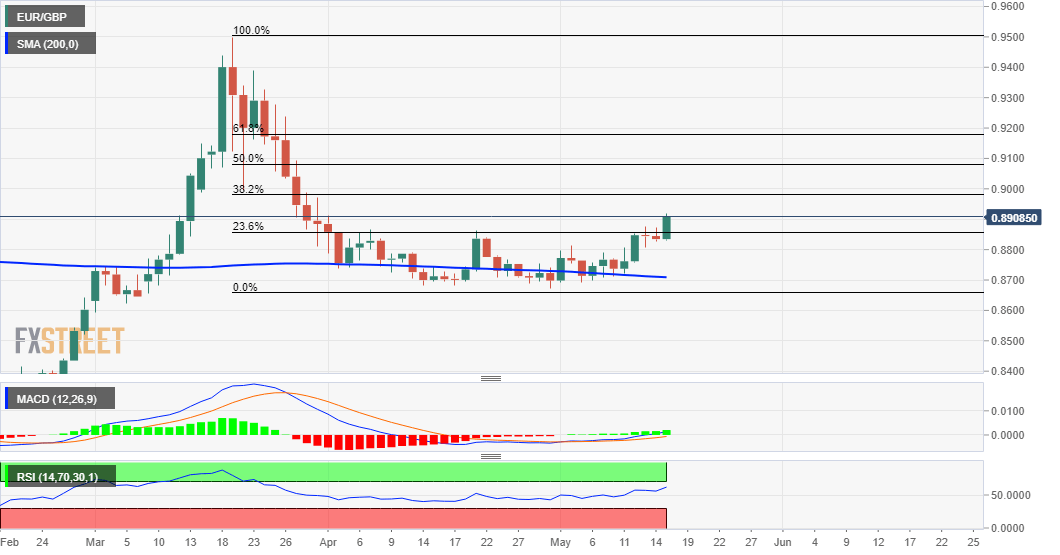

The EUR/GBP cross gained some strong positive traction on the last trading day of the week and climbed further beyond the 0.8900 mark, hitting the highest level since March 31.

The momentum assisted the cross to finally break through a 1-1/2-month-old trading range and a resistance marked by 23.6% Fibonacci level of the 0.9500-0.8671 bearish fall.

Meanwhile, technical indicators on the daily chart have just started moving into the bullish territory and support prospects for an extension of the ongoing positive move.

Some follow-through buying has the potential to lift the cross towards its next major hurdle near the 38.2% Fibo. level, just ahead of the key 0.9000 psychological mark.

The 0.8860-50 resistance breakpoint now seems to protect the immediate downside. Any dips towards the mentioned resistance-turned-support should be seen as a buying opportunity.

EUR/GBP daily chart

Technical leels to watch