Back

28 May 2020

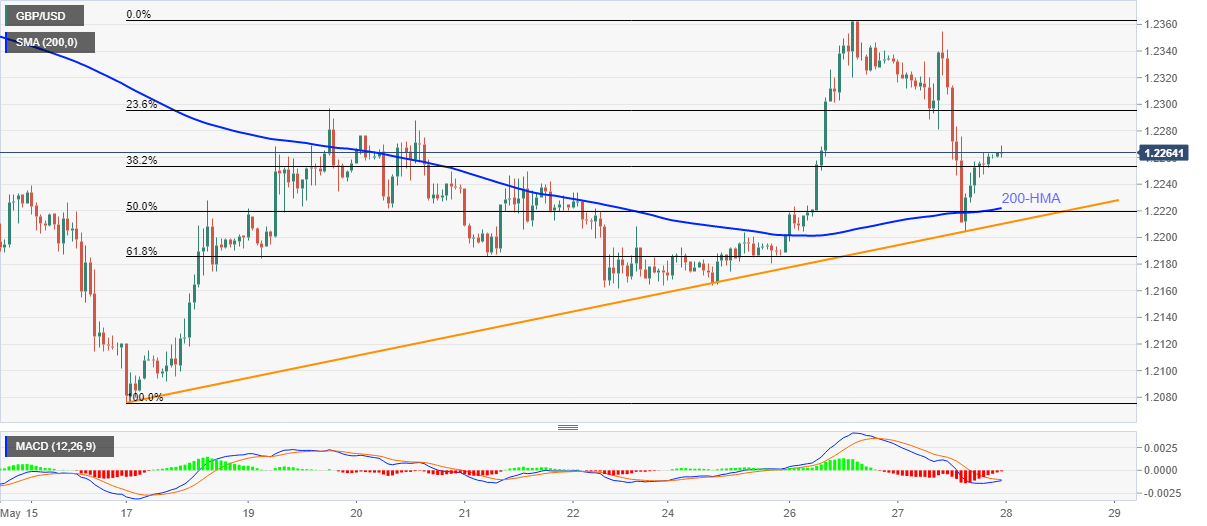

GBP/USD Price Analysis: Keeps pullback from short-term support line above 1.2200

- GBP/USD buyers catch a breath after portraying a recovery from 1.2204.

- 200-HMA, 61.8% Fibonacci retracement add to the support.

- 1.2300 becomes immediate upside barrier ahead of Wednesday’s top.

GBP/USD remains firm around 1.2265 amid the initial Asian session on Thursday. The Cable recently bounced off an ascending trend line from May 17 as well as 200-HMA.

As a result, buyers are firming up the grip to aim for 1.2300 round-figures before challenging the previous day’s top near 1.2365.

In a case where the bulls remain dominant past-1.2365, May 08 peak around 1.2470 will be the key to watch.

On the downside, a confluence of 200-HMA and 50% Fibonacci retracement level of May 17-26 upside, close to 1.2220/15, could restrict the pair’s immediate declines before the said support line around 1.2210.

Also acting as strong supports are 61.8% of Fibonacci retracement near 1.2185 and Friday’s lows near 1.2160.

GBP/USD hourly chart

Trend: Further recovery expected