Gold Price Analysis: XAU/USD probes two-week-old support line under $1,730

- Gold fails to hold the uptick to $1,737.83.

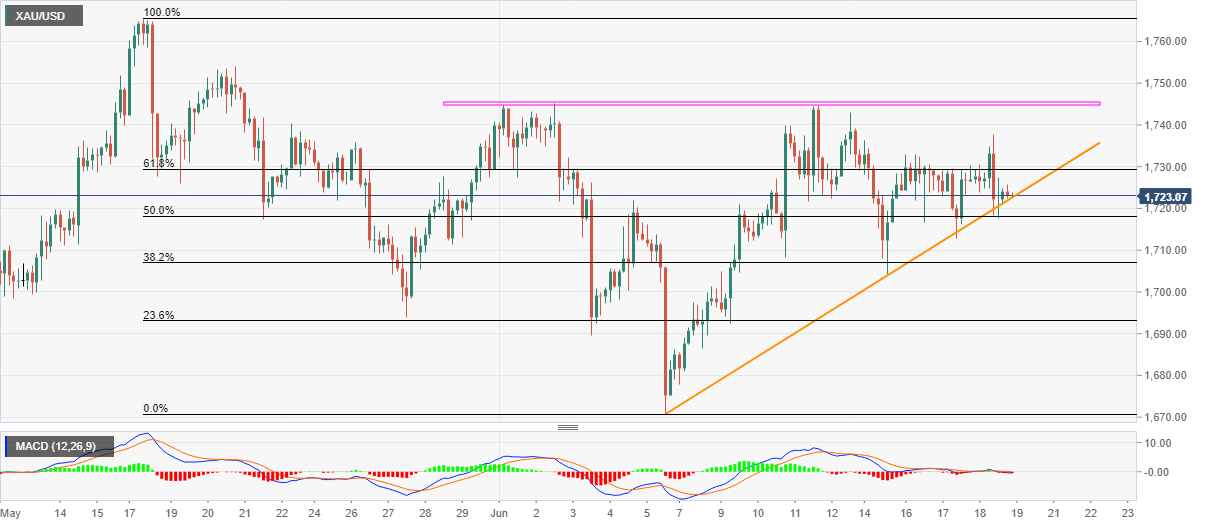

- Bearish MACD, repeated failure to stay beyond $1,730 favor sellers.

- Buyers will stay away until the break of $1,745.12.

Gold prices ease to $1,723.10 during the early Friday morning in Asia. As a result, the yellow metal steps back from $1,737.83 while repeating the inabilities to stay beyond $1,730. Additionally, the quote tests an ascending trend line from June 05 amid bearish MACD conditions.

Against this backdrop, the bears are waiting for a clear break below $1,720 to confirm the ascending triangle formation. In doing so, the weekly bottom surrounding $1,704 will become their immediate target ahead of watching over June 03 low of $1,689.

In a case where the bullion prices keep declining below $1,689, the monthly trough at $1,670 could be attacked.

Alternatively, $1,730 acts as nearby resistance ahead of the horizontal upside barrier around $1,745, comprising multiple highs marked during the month.

Should there be a clear break above $1,745, $1,754 and the previous month’s peak adjacent to $1,765.40 could lure the bulls.

Gold four-hour chart

Trend: Bearish