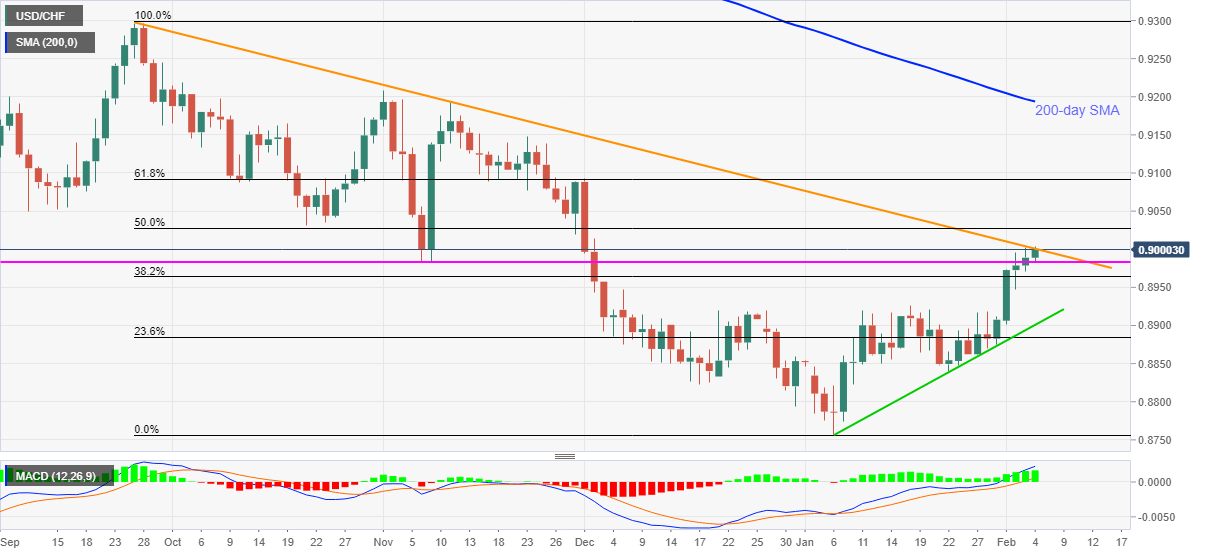

USD/CHF Price Analysis: Refreshes two-month high around 0.9000, bulls look to retake controls

- USD/CHF pierces key resistance line from September 25 while taking the bids bear multi-month top.

- Bullish MACD favor further upside towards the key Fibonacci retracement levels, SMA.

- Sellers may look for entries below one-month-old support line.

USD/CHF rises to the fresh high since early December 2020, currently up 0.15% intraday to 0.9002, during the pre-European session on Thursday.

In doing so, the USD/CHF buyers attack a key resistance line amid bullish MACD, which in turn suggests further upside momentum towards 50% Fibonacci retracement of September 2020 to January 2021 declines, at 0.9027.

However, any further advances will have to cross the 61.8% Fibonacci retracement level of 0.9091 and the 0.9100 round-figure to revisit the 200-day SMA level near 0.9195.

During the quote’s fresh weakness, lows marked during November 2020, near 0.8980, can entertain short-term sellers before directing them to January top near 0.8925.

Though, USD/CHF bears will remain cautious unless witnessing a daily closing below an ascending support line from January 06, currently around 0.8900.

To sum up, USD/CHF bulls are set to retake controls after five months of downward trajectory.

USD/CHF daily chart

Trend: Further upside expected