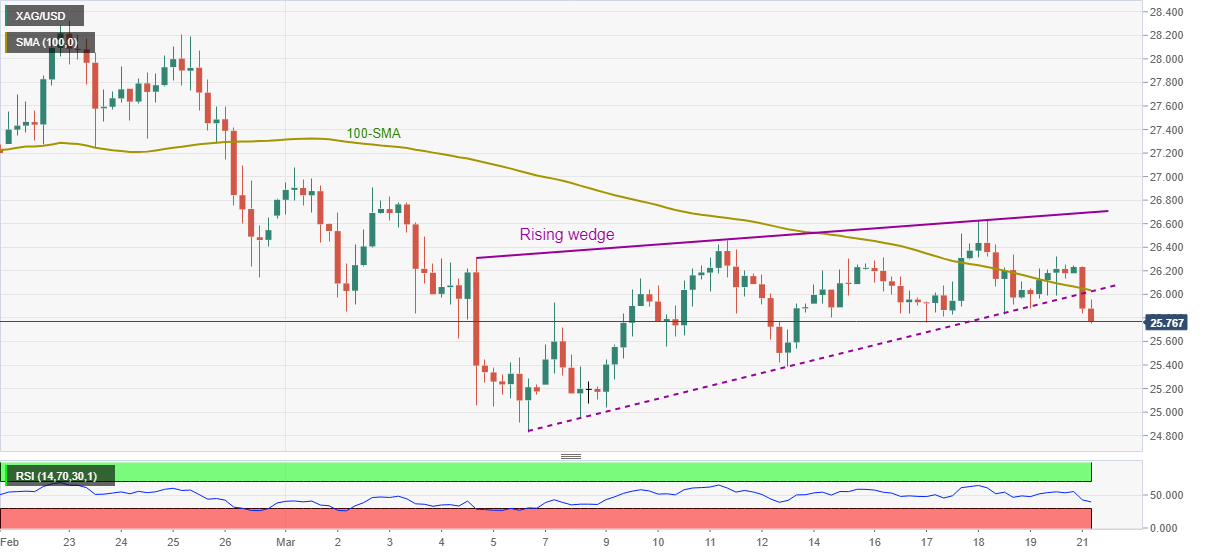

Silver Price Analysis: XAG/USD drosp below $26.00 on rising wedge confirmation

- Silver takes offers after confirming a bearish chart pattern, near intraday low.

- Downbeat RSI adds to the sellers favor, 100-SMA strengthens upside barrier.

Silver refreshes intraday low to $25.78, currently down 1.7%, during Monday’s Asian session. The white metal confirmed a bearish chart pattern, rising wedge, on the four-hour (4H) formation earlier in Asia.

Given the downward sloping RSI adding strength to the bearish chart pattern’s confirmation, silver is likely to revisit the monthly low surrounding $24.80.

Though, the $25.00 round-figure and February 12 low around $25.30 can offer intermediate halts during the quote’s anticipated south-run.

Meanwhile, recovery moves will have 100-SMA as an extra hurdle, in addition to the rising wedge’s support, around $26.00.

If at all the white metal regains $26.00, an ascending resistance line from early March, at $26.70 now, could test the commodity buyers going forward.

Silver four-hour chart

Trend: Further weakness expected