Back

22 Mar 2021

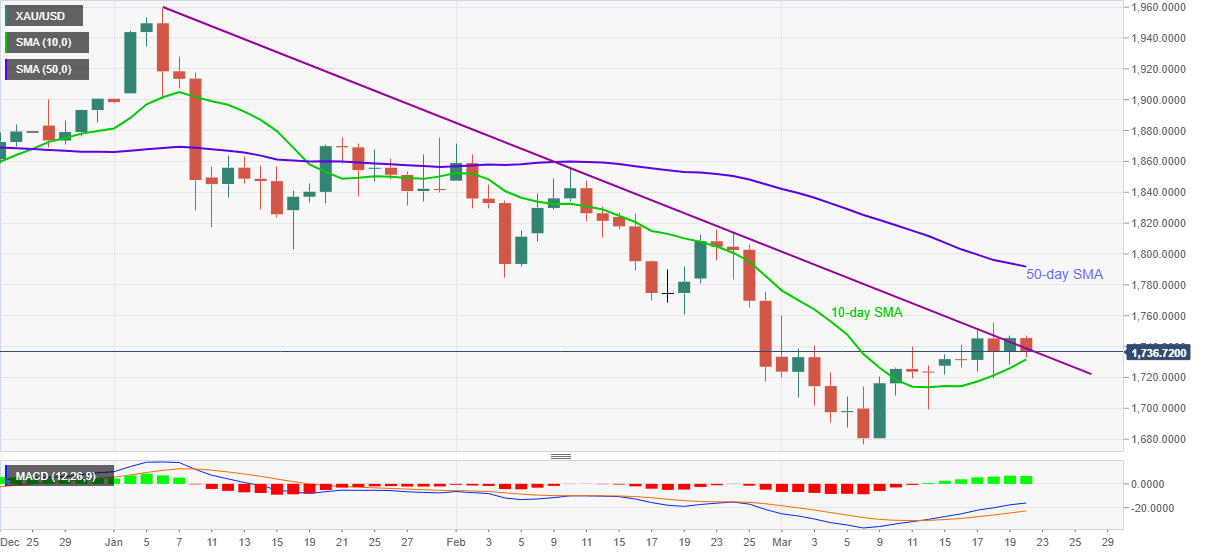

Gold Price Analysis: XAU/USD bulls stay hopeful despite recent losses targeting $1,730

- Gold bounces off intraday low but keeps flirting with 11-week-old trend line resistance.

- 10-day SMA, bullish MACD tests latest downside, bulls have a bumpy road ahead.

Gold portrays a corrective pullback from the day’s low of $1,732.61, currently down 0.50% near $1,737, during early Monday. In doing so, the yellow metal rejects Friday’s upside break of short-term key resistance.

However, bullish MACD and the commodity’s sustained trading above 10-day SMA keeps gold buyers hopeful above $1,731.

Also acting as the downside filter is the $1,700 threshold and the recent low near $1,675.

Meanwhile, a clear break above the stated resistance line, near $1,740, will have to cross the previous week’s top surrounding $1,755 before eyeing November 2020 lows around $1,765.

Additionally, the 50-day SMA level of $1,791 and the $1,800 round-figure offer extra resistance levels to the commodity.

Gold daily chart

Trend: Pullback expected