EUR/USD Price Analysis: Complex candlesticks trouble bulls above 1.2000, ECB in focus

- EUR/USD picks up bids to intraday high ahead of the week’s key event.

- ECB is expected to offer no fireworks but the BOC move keep momentum traders hopeful.

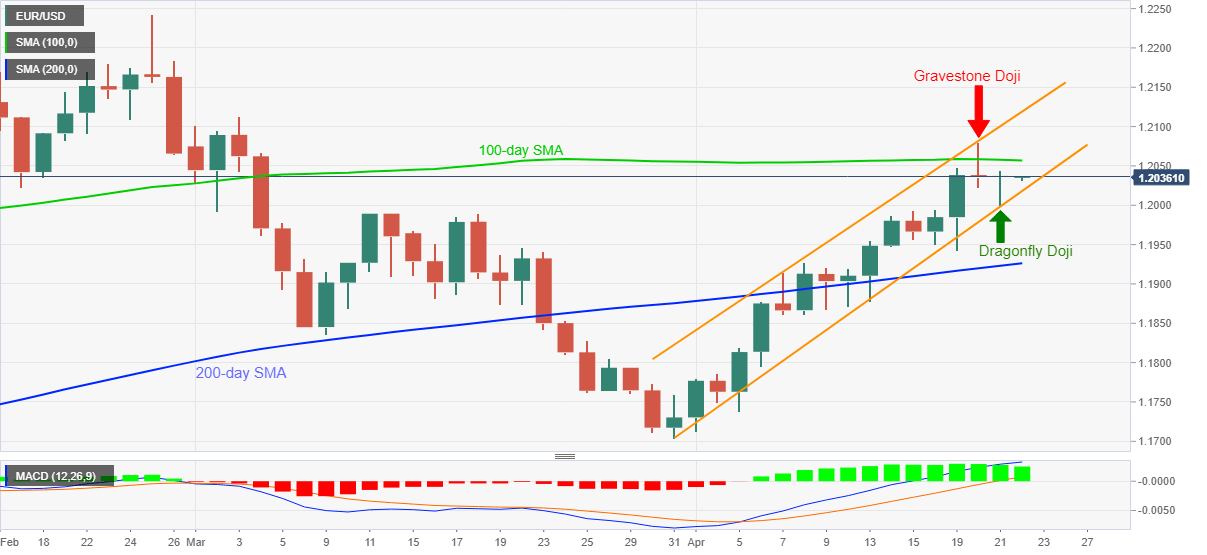

- Gravestone, followed by Dragonfly, test bulls between the key SMA, inside monthly rising channel.

EUR/USD extends late Wednesday’s recovery move to early Thursday in Asia while picking up bids to 1.2036. However, cautious sentiment before the European Central Bank (ECB) monetary policy meeting and mixed candlesticks on the daily chart probe the bulls.

Although Gravestone Doji’s lead over the Dragonfly Doji candlestick suggests the restoration of the overall bullish trend, which was tested on Tuesday, 100-day SMA guards pair’s immediate run-up around 1.2055.

Even if the quote manages to cross the 1.2055 nearby hurdle, March month’s top and the upper line of a monthly rising channel, around 1.2115-20, will be a tough nut to crack for the EUR/USD buyers.

Alternatively, the quote’s downside break of the stated channel’s support near 1.2020 will be questioned by the 1.2000 threshold and tops marked during March 11-18 around 1.1990.

Also acting as the key support is the 200-day SMA level of 1.1926.

EUR/USD daily chart

Trend: Sideways