Gold Price Analysis: XAU/USD refreshes intraday low below $1,800 but buyers can stay hopeful

- Gold fizzles the previous day’s strong upside momentum.

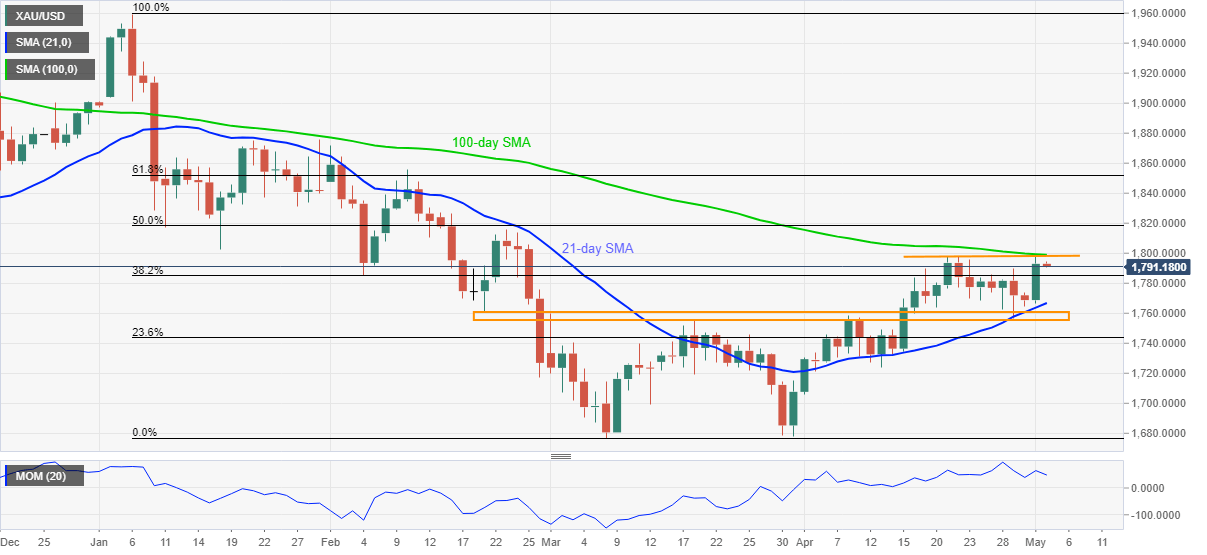

- 100-day SMA, two-week-old horizontal resistance limit immediate upside.

- 21-day SMA, $1,760–55 will test the short-term bears.

Gold drops to the day's fresh low of $1,790.71, down 0.13% on a day, during Tuesday’s Asian session. In doing so, the yellow metal eases below the key $1,800 resistance amid the recently weakening Momentum indicator.

Sellers seem to attack 38.2% Fibonacci retracement of January–March downside, near $1,785, a break of which will extend the latest pullback towards 21-day SMA level close to $1,766.

However, any further downside will be challenged by the broad support zone comprising multiple levels since late February around $1,760–55.

Meanwhile, further upside needs to provide a daily closing beyond the $1,800 threshold to attack late February tops surrounding $1,816 and 50% Fibonacci retracement level near $1,819.

In a case where gold remains firm above $1,819, 61.8% Fibonacci retracement level close to $1,851 and February’s high of $1,855.50 will be the key to watch.

Gold daily chart

Trend: Pullback expected