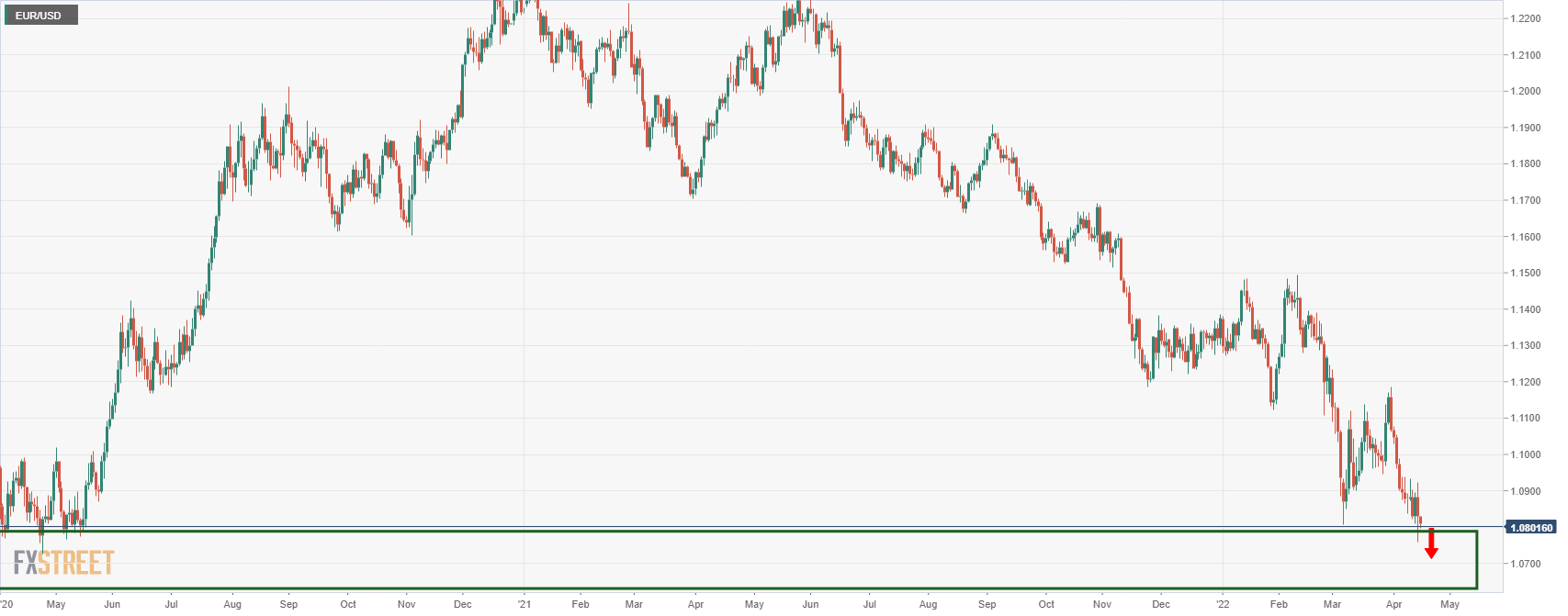

EUR/USD Price Analysis: Bears in control, but weekly M-formation is menacing

- EUR/USD bears in control and targets a deeper demand area for the foreseeable future.

- The M-formation on the weekly chart contradicts the bearish bias.

The euro is bobbing along the bottom of the bear cycle range and likely has more to go to the downside in order to mitigate the imbalance left behind from the March 2020 rally down in the 106 areas. The following illustrates this from a daily and 4-hour perspective, albeit the caveat comes in the weekly chart:

EUR/USD daily chart (i)

The bears are fully in control at this juncture in a very strong downtrend with very few corrective bars this month so far.

EUR/USD daily chart (ii)

The price has formed a resistance, as more evident here in the four-hour time frame:

EUR/USD H4 chart

The price has made a 38.2% Fibonacci retracement and is stalling. Therefore, the path of least resistance would be expected to be to the downside.

However, the weekly chart's M-formation should also be noted and considered as a risk:

EUR/USD weekly chart

The M-formation is a reversion pattern and the neck line would be expected to be retested in due course.